We recently shared our top insights on the Giving USA 2024 report with a wonderful group of nonprofit leaders.

They also asked some very interesting questions about fundraising trends and how their fundraising programs might be impacted.

Here are the main Giving USA 2024 FAQs we received – along with answers, of course!

If you’d like a copy of the webinar recording, just send us an email.

Giving Trends from 2023

As a refresher, 2023 was a phenomenal year for charitable giving. Total charitable donations hit a whopping $557.16 billion!

It’s an important reminder of the consistency of American generosity, even with inflation running at 4.1% and tempering the overall results.

Who is Giving and What Are They Giving To?

Giving USA insights cover WHO is doing the giving – individuals, foundations, bequests, and corporate giving.

It also covers WHAT people are giving to.

We track giving in nine major nonprofit subsectors: Religion; Human Services; Education; Foundations; Public-Society Benefit; Health; International Affairs; Arts, Culture, and Humanities; and Environment and Animals.

You can find our comprehensive review of the Giving USA results here.

Smart Questions from our Webinar Attendees:

Everyone’s SMART questions ran the gamut! And we know they were all asking, “What does Giving USA 2024 mean for my nonprofit?”

So let’s get started:

Question: Are donors giving less again and what are the trends in individual giving?

We’ll shout this from the rooftops: Individuals are the leading source of charitable giving!

Individual giving went up significantly during the pandemic. However, gifts have since come down from those high levels, since pandemic-related gifts in 2021 were unusually strong.

This decline should not be a major cause for concern in the least, as giving is still above pre-pandemic levels, even when adjusted for inflation.

While donors are still incredibly generous, the way individual donors are giving is changing. Many more individuals are choosing to give through their private foundations and DAFs, so it’s important for you to:

- Understand these giving vehicles

- Identify the distinct donors who give this way

- Mention these giving channels in your comms

- Flag DAF donors as major gift prospects!

Question: Are more gifts being made from IRAs?

Yes, it’s time to learn more about IRA required distributions. Why? Because this is a fact of life for many donors who are in their prime giving years.

Our most populous generation – The Baby Boomers – are reaching the age where they must begin taking “required minimum distributions” (RMDs) from their retirement accounts, including:

- IRAs

- 401(k), 403(b), and 457(b) plans

Many older Americans choose to donate that money to charities so they can receive the associated tax benefits.

Your takeaway: be prepared to ask for, foster, and steward these types of gifts. They offer great potential!

- Remind donors about “giving from your IRA” or “making gifts of stock.”

- Add real-life testimonials to your donor communications.

- Remind donors to consult with their financial advisors about these gifts.

You don’t have to know everything about tax laws and their implications. You just have to know enough to point your donors in the right direction – and then back to your organization to make their gift designation!

Question: How should we best handle DAF gifts to honor the donor?

Remember, even though the gift comes from another source – the DAF – it’s the donor’s original contribution that made it all possible.

We often hear about the “unknown” DAF donor, and yes, it can be a challenge.

The reality is that less than 5% of DAF donors give anonymously.

Some ways to identify DAF donors are:

- Survey your donors to learn their preferred vehicle for giving.

- Consider asking donors directly whether they use a DAF..

- Work with your Board and other key stakeholders to identify prospects they may know who use a DAF.

On your website:

- Create a “ways to give” page that includes specific information on DAFs.

- Consider other targeted communications that highlight DAFs as a way to give.

For more help uncovering the identity of the donor, you can even reach out to the DAF provider itself. We strongly recommend this approach!

Many offer helpful guidance, like this from Fidelity, to guide your efforts. The legwork will be worth it.

You can also ask donors how they came to create their DAF. Then, you might find out more about their philanthropic motivations and goals – discovering how and why they give.

Question: Why has giving to the religion sector taken such a hit in recent years?

While giving to religion still represents the largest share of support in Giving USA – and has for the last 40+ years – that share is indeed getting smaller each year.

This is for two reasons:

- Studies show that people, especially younger generations, are becoming less involved with and supportive of organized religion.

Trends indicate organized faith is declining in popularity and houses of worship are seeing declining attendance.

- Other sectors continue to take a greater market share of philanthropic dollars.

Why? There seems to be an increased awareness of a greater diversity of causes. And many other organizations are using increasingly sophisticated fundraising strategies.

It’s important to note that while giving to organized religion is declining, people are still giving to faith-based causes.

This could be, for example, a homeless shelter run by a local church, a relief service run by a Jewish Community Center, or refugee resettlement services aided by your local mosque.

This is a reminder that your donor’s values may still align with many faith-based causes.

Some analysis suggests donors want more stewardship from religious organizations on how their gifts are making an impact.

Your takeaway: If you are in a faith-based organization – be sure to use top notch stewardship and donor communications strategies to keep your donors close.

Question: What tips do you have for managing donor nervousness about the next presidential administration?

While the latest Giving USA report focuses on 2023: there is a very big 2024 event on our audiences’ minds: the upcoming election and all that comes with it!

Here are our tips to help you navigate a potentially stormy season:

Accentuate the Positive!

- Focus communications on the positive impact and problem-solving work your organization is doing, rather than political issues or conflicts.

- Emphasize how your lovely donors are making such a difference.

Keep Your Donors Close!

- Remind donors that you provide a “bright light” and distraction from any negativity in the media through your mission and impact.

- Keep donors feeling closely connected through personalized outreach, expressing how much their support is appreciated.

- Send more thank you gifts or notes.

Build Confidence!

- Structure appeals and stories to keep donors feeling their philanthropy is in good hands

- Even more, their gifts are making a tangible difference, regardless of outside events or distractions.

Do you have more pressing questions about Giving USA or the ways that giving statistics have an effect on your donors?

We’d be happy to chat! Just connect with us via email, and as always, thank YOU for being a bright light in our field.

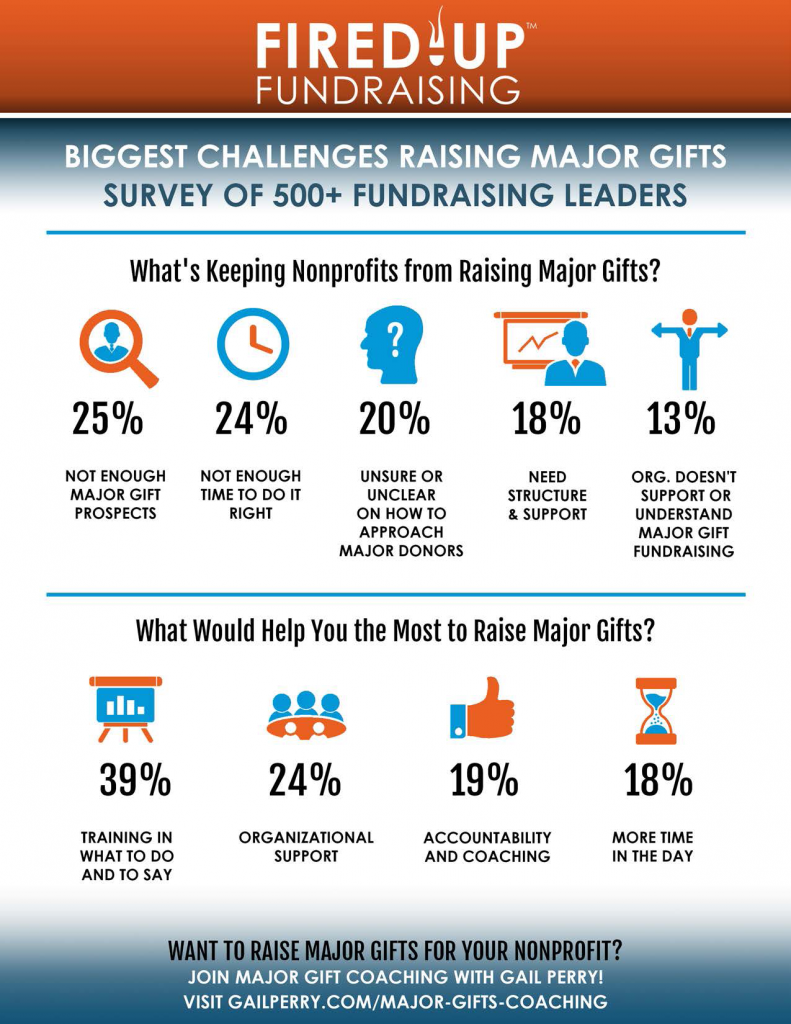

Not Enough Major Gift Prospects 25%

Not Enough Major Gift Prospects 25% Not Enough Time To Do It Right 24%

Not Enough Time To Do It Right 24% Unsure, unclear of how to approach major donors 20%

Unsure, unclear of how to approach major donors 20% Need Structure and Support 18%

Need Structure and Support 18% Organization doesn’t understand or support major gift fundraising 13%

Organization doesn’t understand or support major gift fundraising 13% Training In What To Do and Say 39%

Training In What To Do and Say 39% Organizational Support 24%

Organizational Support 24% Accountability and Coaching 19%

Accountability and Coaching 19% More Time in the Day 18%

More Time in the Day 18%